Why switch to an Electric Vehicle?

Embrace the future of driving with electric vehicles (EV) and discover a smarter, more sustainable way to hit the road.

➔ Low Operating Costs: Electric vehicles have fewer moving parts, reducing maintenance costs, and charging an EV is much cheaper than fuelling petrol or diesel cars.

➔ Environmental Impact: By driving an EV, you help reduce air pollution and greenhouse gas emissions, contributing to a cleaner, healthier planet

➔ Strong Resale Value: Benefit from strong EV resale value, giving you a healthy return on your investment.

The advantage of AANT Novated Leasing

➔ Cost Savings: Cost Savings: Take advantage of Government incentives for EV ownership and Include finance repayments and vehicle running costs in your pre-tax salary deductions, reducing your taxable income.

➔ Easy Management: AANT assist with all the paperwork, from finance approvals to insurance and maintenance, making sure your transition to EV is smooth and hassle-free.

➔ Bundled Costs: Novated Leasing simplifies personal finances by bundling all vehicle-related expenses into a single, manageable payroll deduction. Allowing you to track and budget for your car expenses without any surprises.

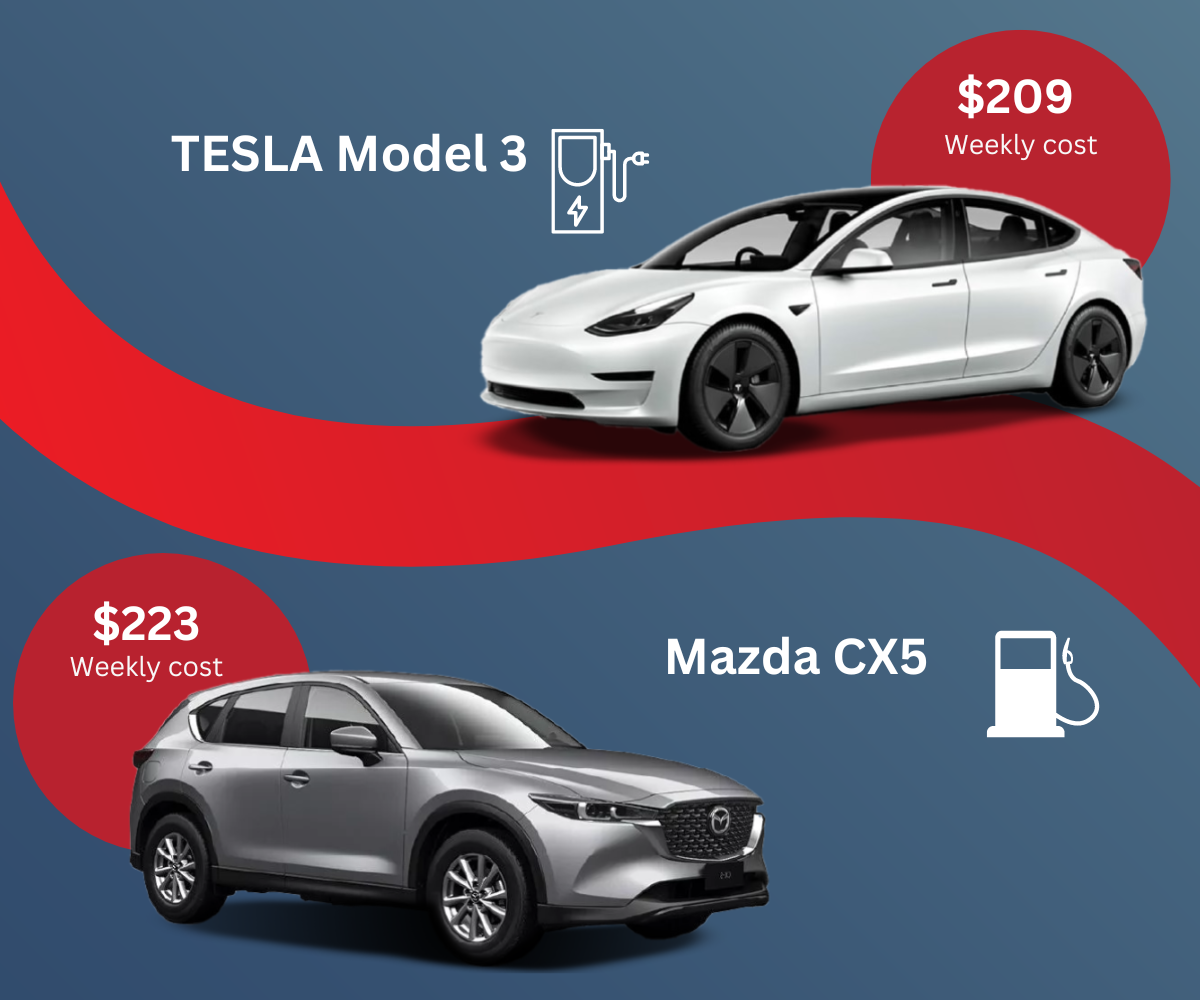

On the surface, the price of a Tesla may seem daunting compared to traditional vehicles like the Mazda CX-5. But when you factor in novated leasing, the affordability of driving a Tesla becomes remarkably close to that of a Mazda.

At AANT, we make savings personal

Get a personalised quote from AANT to discover how much you could save with EV novated leasing. It's a quick and straightforward way to understand the potential financial benefits of transitioning to electric.

Explore Your Options:

Browse our extensive range of electric vehicles to find your perfect match. With AANT's support, making the switch to electric has never been easier.

Vehicle deals

Mitsubishi Outlander PHEV ES AWD

Includes $80 per week in running costs

Tax Savings $42,531

All Novated Lease packages include;

- Finance Repayments

- Tyres

- Fuel

- Servicing

- Registration

- Insurance

EV Ownership: your questions answered

Considering a switch to an electric vehicle (EV)? AANT has all the information you need to understand and navigate the world of EVs. Let's clarify some common queries and highlight the advantages of going electric.

- What is an electric vehicle

An electric vehicle (EV), as defined by the Electric Vehicle Council, operates fully or partly on electricity. Battery electric vehicles (BEVs) run exclusively on electricity, recognizable by their absence of an exhaust pipe. Plug-in hybrid electric vehicles (PHEVs) combine an electric motor with a petrol engine, which is used when the battery runs low. Hybrid electric vehicles (HEVs) also use both power sources but have a smaller battery, limiting their electric-only range.

- Does the FBT exemption for electric vehicles (EVs) mean it won't appear on my income statement?

No, even if your electric vehicle (EV) qualifies for the FBT exemption, the vehicle’s value may still need to be reported as a Reportable Fringe Benefits Amount (RFBA) on your Income Statement.

The RFBA is the grossed-up value of certain fringe benefits provided by your employer. Although an EV may be exempt from paying FBT, the reportable value still contributes to your adjusted taxable income. This can impact your eligibility for government benefits (like Family Tax Benefit) and obligations (such as Medicare levy surcharge or HELP repayments).

The purpose of reporting the RFBA ensures the value of non-cash benefits are accounted for when assessing your overall income. If you’re unsure how this might affect your tax situation, we recommend consulting a tax professional.

- What is the Electric Car Discount policy?

The Electric Car Discount, introduced by the Australian Government in December 2022, removes the Fringe Benefits Tax (FBT) on certain low-emission vehicles provided by employers. This makes electric vehicles more accessible through salary-sacrificed novated leases.

- What qualifies as a zero or low emission vehicle?

Vehicles that meet government standards for zero or low emissions include those powered by battery electric, plug-in hybrid electric, or hydrogen fuel cell technologies, designed for carrying fewer than nine passengers and less than one tonne.

- How does an electric vehicle novated lease differ from a petrol vehicle lease?

Lease structures are available for electric and fuel injected vehicles. The key difference is that Electric Vehicles under the luxury limit of $91,387 have both repayments and running costs that are all pre tax and GST free where traditional fuel vehicles are a combination of pre an post tax repayments. The operating costs of an EV are also substantially less than the traditional fuel vehicles. Accordion content.

- What are the costs of leasing an electric vehicle?

A novated lease for an electric vehicle typically offers greater financial benefits compared to other arrangements, thanks to substantial tax savings on the purchase and lower ongoing operating costs.

- How do electric vehicle running costs compare to petrol cars?

Operating an EV is generally less expensive than a petrol car. EVs require less maintenance due to fewer moving parts and simpler engineering. Service costs are also lower. Additionally, electricity for powering an EV costs less than petrol, offering substantial savings over time.

- How are running costs covered in an electric vehicle novated lease?

Running costs, including servicing, registration, and insurance, are included in your lease payments, similar to petrol vehicle leases. You can account for electricity costs by showing usage through devices like home fast chargers or separate smart meters.

- Can I drive to Litchfield in my EV?

Range anxiety is a common concern, but many EVs now offer sufficient range to comfortably make trips like driving to Litchfield. The range varies by model, but several can travel long distances on a single charge, easing fears of running out of power.

- Are EVs a fire hazard?

EVs are actually less likely to catch fire than vehicles with internal combustion engines. Fire incidents in EVs are rare and typically result from external factors.

- How safe are electric vehicles?

All electric vehicles must meet the same Australian car safety standards as other vehicles. Also, as the battery is located near to the ground, the cars centre of gravity is much lower, providing much better handling. You’re also not carrying around a tank full of petrol/

- Can EV batteries be recycled?

Yes, the technology for recycling lithium-ion batteries has advanced considerably, allowing for over 90% of the materials to be recovered and reused. Used EV batteries can also be repurposed for energy storage in residential and commercial settings.

All novated examples are based on a 60-month term, traveling 15,000 kms per annum, and based on an $85,000 annual income. Images are for display and illustration purposes only. Vehicle supply is subject to availability, and pricing may change at the manufacturer's discretion, which could affect the estimated figures listed above. Novated leasing or vehicle packaging works for the employee by substituting a taxable benefit compared to their current personal scenario. The above figures represent the estimated net impact on your income, taking into account the assumed tax and GST savings. All applications are subject to normal credit criteria and assessment, along with loan/lease suitability. Terms, conditions, fees, and charges may apply. It is best to seek financial advice from an independent specialist, such as an accountant, regarding your personal circumstances before solely relying on these figures.